Loan Details

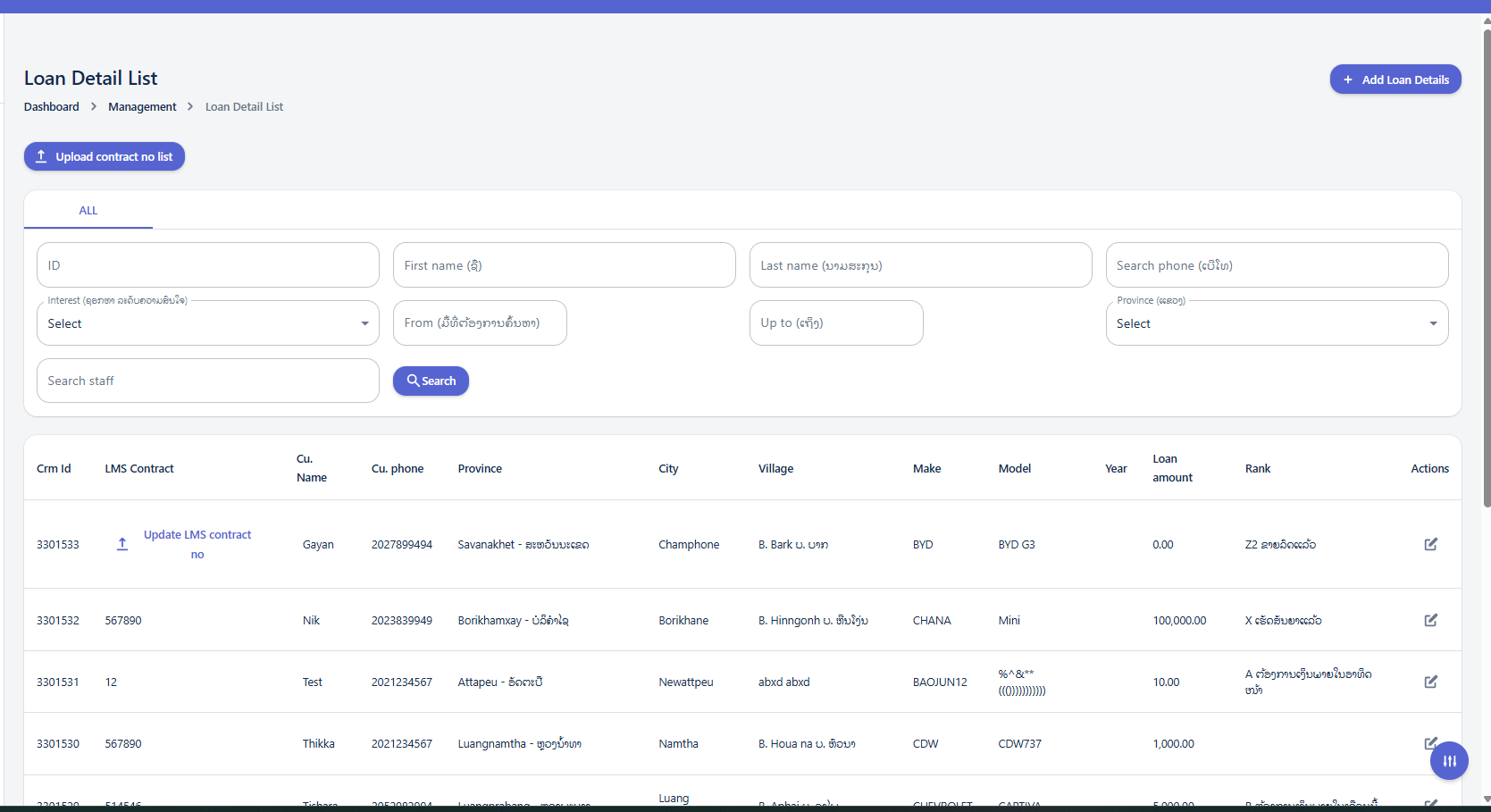

Page Overview

The "Loan Detail List" page provides a comprehensive view of all loan details. It includes a dashboard navigation, search and filter options, and a detailed table displaying various loan attributes.

Using the Search and Filter Panel

The search and filter panel allows you to quickly find specific loan details by applying various criteria.

Available Filters:

-

ID: Enter a specific loan ID to find an exact match.

-

First name: Search for loans associated with a customer's first name.

-

Last name: Search for loans associated with a customer's last name.

-

Search phone: Enter a phone number to find loans linked to that contact.

-

Interest: Use the dropdown to select a specific interest rate.

-

From [Date Field]: Select a start date for a date range search.

-

Up to [Date Field]: Select an end date for a date range search.

-

Province (ລາວ): Use the dropdown to select a specific province for filtering.

-

Search staff: Enter the name or ID of a staff member to filter loans by staff.

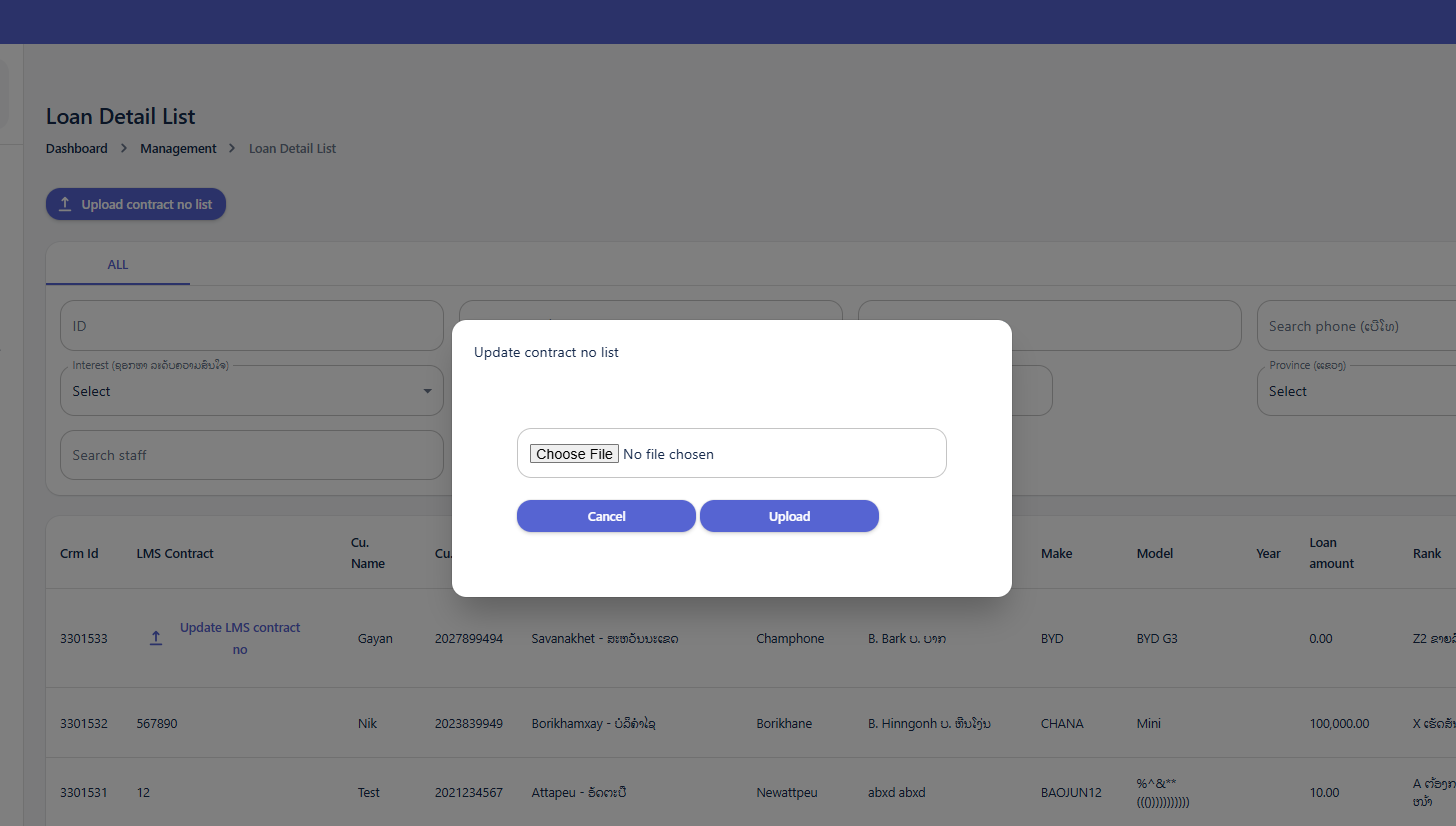

Upload Contract No List

When click the Upload contract no list button, The "Update contract no list" popup window will appear in the center of the screen.

-

File Input Field:

Choose File No file chosen- This is where you select the file you wish to upload. -

Action Buttons:

-

Cancel: Closes the popup without uploading any file. -

Upload: Initiates the file upload process after a file has been selected.

-

Add Loan Details

The "Customer Create" page is designed for entering new customer information into the system, potentially linking them to loan applications or existing loan records.

-

Dashboard > Management > Loan Details: This breadcrumb trail indicates that you are accessing this "Customer Create" form as part of a broader management process, likely linked to creating new loan details.

Customer Basic Information (ព័ត៌មានមូលដ្ឋានអតិថិជន)

This section captures essential administrative details for the customer.

Basic Information Fields (ຂໍ້ມູນພື້ນຖານ)

This section contains crucial fields for setting up the customer record:

-

Staff: This field displays the name of the staff member who is creating or managing this customer record.

-

Example Value: "Lmsv2 Admin"

-

Action: This is likely a read-only field, automatically populated with your logged-in user name.

-

-

Staff Id: This field displays the ID of the staff member.

-

Example Value: "55555"

-

Action: Similar to "Staff," this is probably a read-only field, automatically populated.

-

-

Input date: This indicates the date when the customer information is being entered into the system.

-

Example Value: "2025-07-07"

-

Action: This field is likely auto-populated with the current date. You may or may not be able to change it depending on system configuration.

-

-

Interest (ເງິນສົນໃຈ/ດອກເບ້ຍ)*: This is a mandatory dropdown field. It likely refers to the type of interest or perhaps the initial interest status related to the customer's inquiry or potential loan.

-

Action: Click the dropdown and select the appropriate option from the list.

-

-

Visited (ສະຖານະການເດີນທາງໄປຢ້ຽມຢາມ): This field features a toggle switch. It indicates whether the customer has been physically visited by staff.

-

Action: Click the toggle switch to turn it ON (indicating "Visited") or OFF (indicating "Not Visited").

-

-

Source of customer (ແຫຼ່ງທີ່ມາຂອງລູກຄ້າ)*: This is a mandatory dropdown field. It's crucial for tracking how the customer came to know about your services.

-

Action: Click the dropdown and select the source (e.g., Referral, Advertisement, Walk-in).

-

-

Request route (ເສັ້ນທາງການຮ້ອງຂໍ)*: This is a mandatory dropdown field. It specifies the channel or process through which the customer's request (e.g., for a loan) was initiated or is being processed.

-

Action: Click the dropdown and select the appropriate request route.

-

-

Outstanding (ຄ້າງຄືນ/ຍັງຄ້າງຊຳລະ): This field likely indicates any outstanding balance or pending issues related to the customer.

-

Action: Enter the outstanding amount or relevant information if applicable.

-

-

Make request (ເຮັດຄໍາຮ້ອງຂໍ)*: This is a mandatory dropdown field. It probably refers to the type of request the customer is making (e.g., Loan Application, Information Inquiry, Service Request).

-

Action: Click the dropdown and select the specific request type.

-

Customer Create: Customer Information (ព័ត៌មានអតិថិជន)

This section is dedicated to capturing detailed personal, demographic, and work-related information about the customer. It is crucial for building a comprehensive customer profile.

I. Search Customer in CRM (ស្វែងរកអតិថិជន)

Before entering new customer information, it's good practice to check if the customer already exists in the CRM.

-

Tel (លេខទូរស័ព្ទ): Enter the customer's phone number here.

-

Click the Search Button after entering the phone number to search for existing records. If found, you might not need to fill out all the details below.

Customer Information (ຂໍ້ມູນអតិថិជន)

This is the main section for entering new or updating existing customer data. Fields marked with an asterisk (*) are typically mandatory.

-

Tel (លេខទូរស័ព្ទ)*: Enter the customer's primary phone number. This is a mandatory field.

-

Contact number of relative (លេខទំនាក់ទំនងសាច់ញាតិ, សុំ 2 នាក់ដែលមិននៅក្នុងផ្ទះ 1 នាក់): Enter the phone numbers of at least two relatives who do not live with the customer.

-

First Name (ឈ្មោះ)*: Enter the customer's first name. This is a mandatory field.

-

Last Name (នាមត្រកូល)*: Enter the customer's last name. This is a mandatory field.

-

Birth date (ថ្ងៃកំណើត)*: Select the customer's date of birth on this calendar. This is a mandatory field.

-

Age (អាយុ): This field will likely auto-calculate based on the birth date entered.

-

Gender (ភេទ)*: Select the customer's gender from the dropdown list. This is a mandatory field.

-

Marriage (អាពាហ៍ពិពាហ៍): Select the customer's marital status (e.g., Single, Married, Divorced) from the dropdown list.

-

Children (ចំនួនកូន)*: Enter the number of children the customer has.

-

Id card (លេខប័ណ្ណសំគាល់ខ្លួន): Enter the customer's national identification card number.

-

Issued (ចេញដោយ): Enter the issuing authority or place for the ID card.

-

Expired (ផុតកំណត់): Enter the expiration date of the ID card.

-

Unit (អង្គភាព): Enter information about the unit or apartment if applicable.

-

House No (លេខផ្ទះ): Enter the customer's house number.

-

Province (ខេត្ត)*: Select the customer's province from the dropdown list. This is a mandatory field.

-

District (ស្រុក)*: Select the customer's district from the dropdown list. This is a mandatory field.

-

Village (ភូមិ)*: Select the customer's village from the dropdown list. This is a mandatory field.

-

Occupation (មុខរបរ): Enter the customer's occupation.

-

Working years (ឆ្នាំធ្វើការ): Enter the number of years the customer has been working in their current occupation or overall.

-

Company (ក្រុមហ៊ុន/ទីស្ថាប័ន/សហគ្រាស): Enter the name of the customer's company or organization if employed.

-

Position (តំណែង): Enter the customer's job position or title.

-

Working address (កន្លែងធ្វើការ): Enter the customer's work address.

-

Working unit (អង្គភាព): Enter details about the customer's working unit or department.

-

Working house no (លេខផ្ទះកន្លែងធ្វើការ): Enter the house number of the customer's workplace.

-

Working province (ខេត្ត)*: Select the province where the customer works from the dropdown list. This is a mandatory field.

-

Working district (ស្រុក)*: Select the district where the customer works from the dropdown list. This is a mandatory field.

-

Working village (ភូមិ)*: Select the village where the customer works from the dropdown list. This is a mandatory field.

-

Income (ប្រាក់ចំណូល): Enter the customer's income.

-

Expenses (ចំណាយ): Enter the customer's monthly or regular expenses.

-

Net profile (ប្រាក់ចំណេញ): This field might auto-calculate as Income minus Expenses, or it might be a field for entering net profit if the customer is self-employed.

-

Net profile (ប្រាក់ចំណេញ): This field might auto-calculate as Income minus Expenses, or it might be a field for entering net profit if the customer is self-employed.

-

Living status (ស្ថានភាពរស់នៅ): Select the customer's current living situation from the dropdown (e.g., Own home, Renting, Living with family). This is a mandatory field.

-

Need to Sales partner / ទីតាំងចែករំលែក: This field has a toggle switch. It might indicate whether the customer needs to be assigned to a sales partner or if their information should be shared for sales purposes.

-

-

Action: Click the toggle switch to turn it ON or OFF

-

-

- Link WhatsApp: Enter the customer's WhatsApp number or a link to their WhatsApp profile for communication.

-

Addition occupation of customer / អាជីពបន្ថែមរបស់អតិថិជន: Enter any additional occupations or sources of income the customer has.

-

Number of Employee / ចំនួនបុគ្គលិក: If the customer owns a business, enter the number of employees they have.

- Office Location / ទីតាំងការិយាល័យរបស់អតិថិជន: Enter the physical address of the customer's office or business location.

Property Details For Rent (ពត៌មានលម្អិតទ្រព្យសម្បត្តិសម្រាប់ជួល)

This is a critical section for loans or leases that involve a specific asset, most likely a vehicle, being rented out or used as collateral. Fields marked with an asterisk (*) are typically mandatory.

-

-

Maker (ម៉ាក)*: Select the manufacturer or brand of the property/vehicle from the dropdown list. This is a mandatory field.

-

Model (ម៉ូដែល)*: Select the specific model of the property/vehicle from the dropdown list. This is a mandatory field.

-

Condition (ស្ថានភាព)*: Select the condition of the property/vehicle from the dropdown list (e.g., New, Used, Excellent, Good, Fair, Poor). This is a mandatory field.

-

Distance (ចម្ងាយ): If it's a vehicle, enter the mileage or kilometers driven.

-

Vehicle type (ប្រភេទយានយន្ត): Select the type of vehicle (e.g., Car, Motorcycle, Truck) from the dropdown list.

-

Vehicle type remark (កំណត់សម្គាល់ប្រភេទ): Add any additional remarks or specific details about the vehicle type.

-

Power (ថាមពល): Enter the power specifications (e.g., horsepower, engine displacement).

-

Wheel (កង់/សំបកកង់): Select details about the wheels or tires from the dropdown list.

-

Remark (កំណត់សម្គាល់): Add any general remarks or notes about the property/vehicle.

-

Color (ពណ៌): Select the color of the property/vehicle from the dropdown list.

-

Year (ឆ្នាំផលិត): Enter the manufacturing year of the property/vehicle.

-

Engine (ម៉ាស៊ីន): Enter details about the engine (e.g., engine number, engine type).

-

VIN Code (លេខតួ): Enter the Vehicle Identification Number (VIN) for vehicles.

-

Price (តម្លៃ): Enter the purchase price or estimated market value of the property/vehicle.

-

Sell price (តម្លៃលក់): Enter the selling price of the property/vehicle, if applicable.

-

Loan amount (ចំនួនទឹកប្រាក់កម្ចី)*: Enter the specific loan amount being requested or granted for this property. This is a mandatory field.

-

Evaluation (តម្លៃវាយតម្លៃ)*: Enter the appraised or evaluated value of the property/vehicle. This is a mandatory field.

-

Loan Details Fields

-

Fee (ຄ່າທຳນຽມ): Enter any administrative fees or charges associated with the loan.

-

Equal (ເທົ່າກັນ): This field might relate to equal installments or a specific calculation method. Enter relevant value if applicable.

-

Objective (ຈຸດປະສົງໃນການກູ້ຢືມ): Clearly state the purpose or objective for which the loan is being taken (e.g., business expansion, vehicle purchase, personal expenses).

-

Source (ແຫຼ່ງເງິນກູ້ຢືມ): Enter or select the source of the loan funds (e.g., Bank, Microfinance Institution, Private Lender).

-

Loan amount (ຈຳນວນເງິນກູ້ຢືມ)*: Enter the principal amount of money being borrowed. This is a mandatory field.

-

Interest (ດອກເບ້ຍ)*: Enter the interest rate applicable to the loan. This is a mandatory field.

-

Equal to (ເທົ່າກັນ): (Similar to the "Equal" field above) Enter relevant value if applicable.

-

Method (ວິທີການຄິດໄລ່): Select the method used for calculating loan interest or repayments from the dropdown list (e.g., Flat Rate, Reducing Balance).

-

Duration (ໄລຍະເວລາການກູ້ຢືມ): Enter the total duration of the loan (e.g., in months, years).

-

Installment (ເງິນທີ່ຕ້ອງຊຳລະໃນແຕ່ລະເດືອນ)*: Enter the amount of each regular payment (installment) the borrower needs to make. This is a mandatory field.

-

Initial date (ວັນທີເລີ່ມຕົ້ນ...): Select the date when the loan officially begins.

-

Need date (ວັນທີຕ້ອງການກູ້ຢືມ)*: Select the date by which the loan is needed or required. This is a mandatory field.

-

Lease amount classification: If this is a lease, categorize the lease amount here.

-

Additional guarantor / ຜູ້ຄ້ຳປະກັນເພີ່ມເຕີມ: Enter the name or details of any additional guarantor for the loan, beyond the primary borrower.

-

Company name / ຊື່ບໍລິສັດ: If the loan is for a company or associated with a business, enter the company's name.

-

Relationship / ການພົວພັນ: Describe the relationship between the borrower and the additional guarantor or the company.

-

Recommended person's name / ຊື່ຜູ້ຖືກແນະນໍາ: Enter the name of the person who recommended the borrower or the loan.

-

Phone number / ເບີໂທ: Enter the phone number of the additional guarantor or the recommended person.

-

Vehicle number / ເລກທະບຽນ: If this loan is for a vehicle, enter its registration or license plate number.

-

Amount / ຈຳນວນ: Enter a specific amount related to the vehicle or other relevant context if applicable.

Negotiations with customers (ການເຈລະຈາກັບລູກຄ້າ)

This section records the negotiation process and outcome with the customer.

-

Negotiate date (ວັນທີ): Date of the negotiation (e.g., 07/07/2025).

-

Negotiate method (ວິທີການ)*: Select the method of negotiation (mandatory dropdown).

-

Negotiations (text area): Use the rich text editor to type detailed notes about the negotiation, including offers, counter-offers, and agreed terms.

-

Formatting tools: Normal, Bold, Italic, Underline, Bullet List, Numbered List, Link, Clear Formatting.

-

-

Cancel: Discard all entered information and return to the previous page.

-

Create Customer: Save all the entered information and create the new customer and loan record.