Asset Valuation

This asset valuation page is designed to estimate the value of assets associated with specific customers. To begin the valuation process, you'll need to select a customer from the customer list. In other words, customer selection is the starting point for all asset valuations. features available for searching for existing customers:

- Customer ID

- Family Book No

- Phone No

- Customer Name / Company Name

Additionally, the system allows users to create new customer profiles. This is helpful for onboarding new customers who haven't been previously registered in the system.

Collecting detailed information about the assets before proceeding. It highlights that two specific asset types are considered in this valuation process:

- vehicles

- land.

Vehicle: This refers to any motorized conveyance, such as a car, truck, motorcycle, that the borrower owns. The system likely requires details about the vehicle's make, model, year, condition, and any relevant features that might affect its value.

Land: This refers to a specific piece of real estate owned by the borrower. The system might require information about the property's location, size, type (residential, commercial, etc.), and any improvements or structures on the land that contribute to its value.

By collecting detailed information about these two asset types, the system can get a better understanding of the borrower's overall financial picture and their ability to repay the loan. The value of these assets can be used as collateral for the loan, meaning they could be used to recoup some of the loan amount if the borrower defaults.

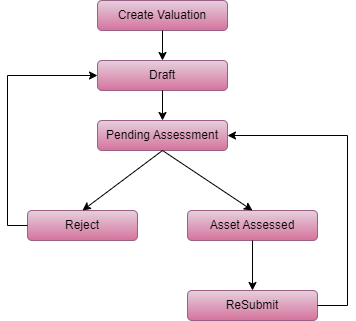

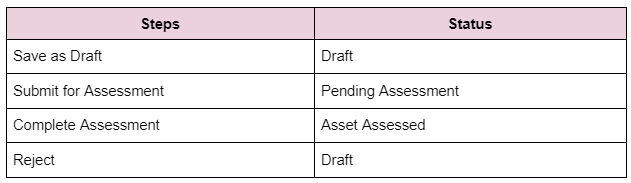

Asset Valuation Process

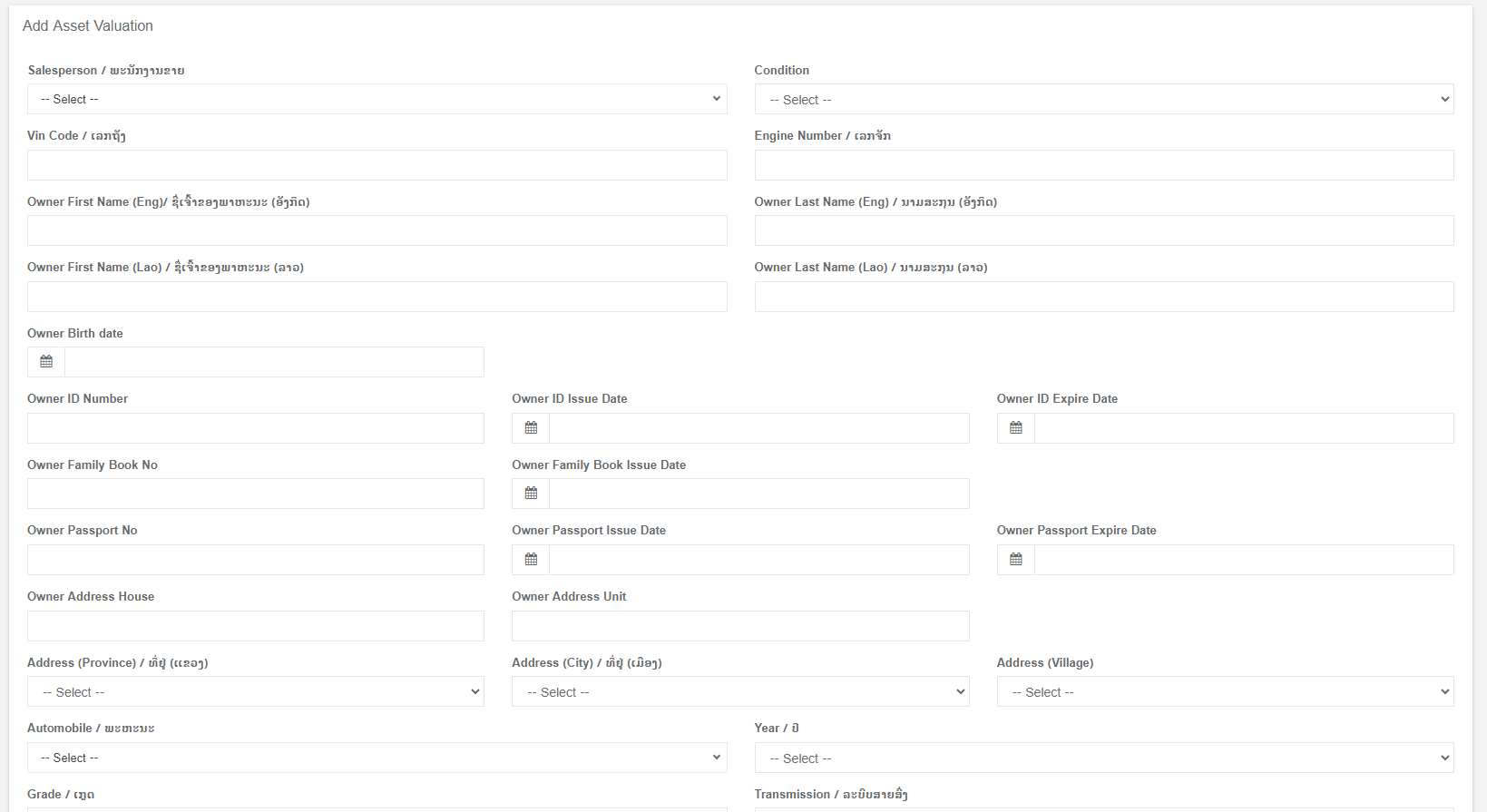

Add Asset Valuation form

After fill the details, there are few steps to approve it.

- Before complete the assessment, there are few new section to fill.

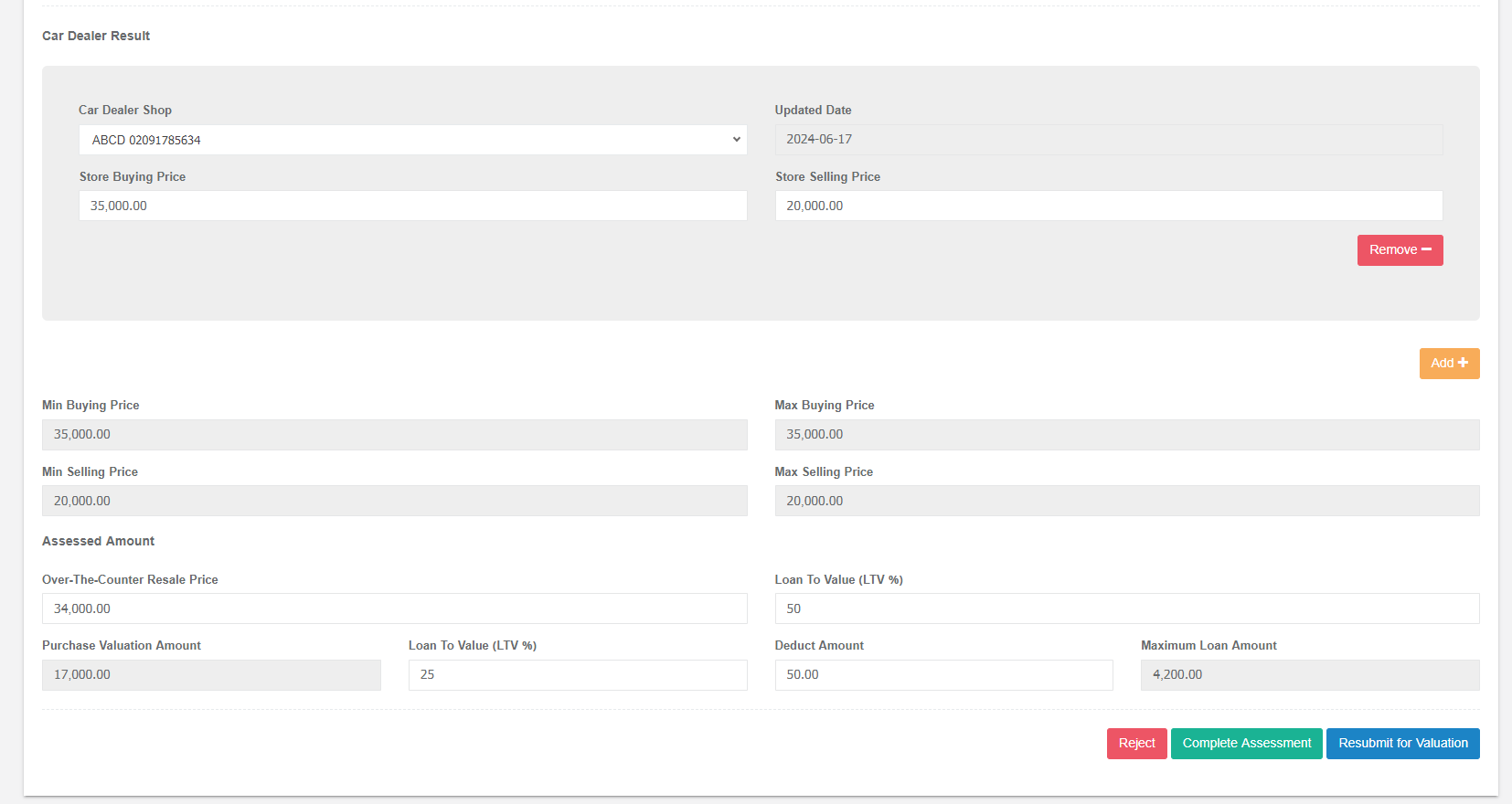

Car Dealer Result Section

This section focuses on collecting data from various car dealers about a specific vehicle you're considering for valuation. It allows you to enter information from multiple car dealers for comparison.

- Car Dealer Shop: This field allows you to enter the name of the car dealership you received the quote from.

- Updated Date: This field lets you specify the date the car dealer's quote was provided. This helps ensure you're considering up-to-date pricing information.

- Store Buying Price: This field is where you enter the buying price offered by the car dealer for the vehicle.

- Store Selling Price: This field is where you enter the selling price listed by the car dealer for the vehicle.

The system automatically calculates the following fields once you've entered data for car dealers:

- Min Buying Price: This field displays the lowest buying price offered by any car dealer you entered information for.

- Max Buying Price: This field displays the highest buying price offered by any car dealer you entered information for.

- Min Selling Price: This field displays the lowest selling price listed by any car dealer you entered information for.

- Max Selling Price: This field displays the highest selling price listed by any car dealer you entered information for.

By having these minimum and maximum values automatically populated, you can easily see the range of buying and selling prices offered by different dealers. This helps you get a better sense of the overall market value of the vehicle.

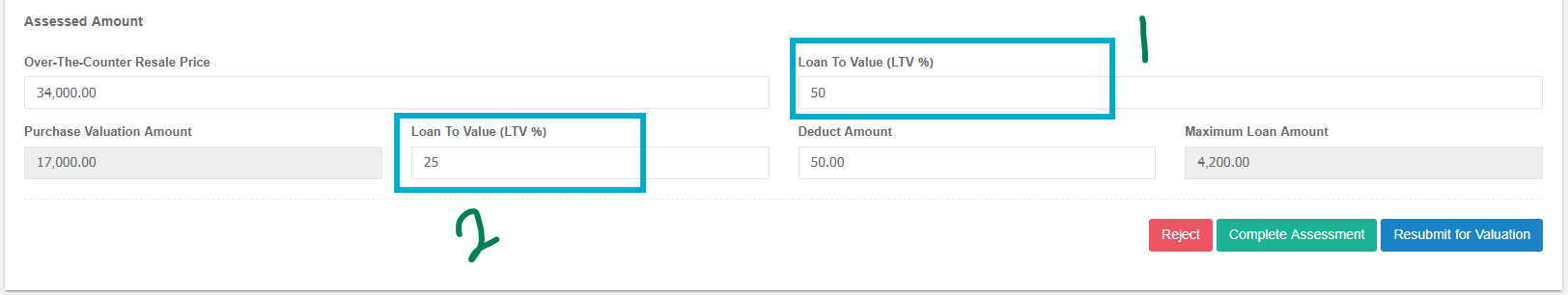

Assessed Amount

Purchase Valuation Amount Calculation

Over-The-Counter Resale Price: This refers to the estimated resale price of the asset (likely the vehicle).

Loan To Value (LTV) [1]: This represents the ratio of the loan amount a borrower can qualify for compared to the appraised value of the asset. It's expressed as a percentage (e.g., 80% LTV).

The system uses the following formula to calculate the "Purchase Valuation Amount":

Purchase Valuation Amount = Over-The-Counter Resale Price * (Loan To Value (LTV)[1])

Maximum Loan Amount Calculation

Loan To Value (LTV) Ratio [1]: As mentioned previously, this represents the percentage of the asset's value that a lender is willing to finance through a loan.

Deduct Amount: This introduces a new variable that represents a specific amount to be subtracted from the initial loan amount calculation.

Maximum Loan Amount = (Purchase Valuation Amount * (Loan To Value (LTV))%)[2] - Deduct Amount

Maximum Loan Amount as a Limit: The "Maximum Loan Amount" calculated by the system serves as a ceiling for the loan amount a borrower can be approved for. This ensures the loan stays within a reasonable range based on the asset's value and the lender's LTV policy.

Loan Approval Criteria: When considering a loan application, the system will verify that the borrower's requested loan amount is less than or equal to the calculated "Maximum Loan Amount." This helps ensure the loan stays within the limits established by the asset's value and the lender's risk tolerance.

No Comments