Loan Contract

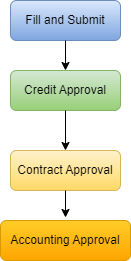

The document creation process begins with the approval of a loan prospect and culminates in the activation of the loan contract upon disbursement approval. This process involves multiple stages of review, approval, and verification.

Contract Approval Process

Loan Prospect Approval:

- A loan prospect is evaluated and approved.

- Upon approval, a loan contract is automatically generated.

Contract Review and Approval:

- The generated contract is subjected to a review process.

- There are three potential outcomes:

-

Resend:

- The contract is returned to the loan prospect draft stage.

- This action typically occurs when significant modifications or corrections are required.

- The process starts again from the initial loan prospecting phase.

-

Request for Contract Check:

- The contract enters a pending approval status.

- This step indicates that the contract requires further evaluation or verification before final approval.

-

Reject:

- The contract is returned to a pending status.

- This decision implies that the contract does not meet the necessary criteria and needs to be revised.

- The approval process restarts from the beginning.

-

Contract Approval:

- Once the contract passes the review, it's approved and moves to the pending disbursement status.

Disburse Payment:

- The contract enters the disbursement approval status.

- This step involves the authorization of the loan amount for disbursement.

Approve Payment:

- The final approval is granted, activating the loan contract.

- The contract becomes legally binding, and the repayment schedule commences.

- Upon successful disbursement, the loan contract becomes active. The borrower is now obligated to make regular repayments according to the outlined collection schedule.

Loan Contract Page

- Contract: This section likely contains the primary terms and conditions of the loan agreement. It may include details such as loan amount, interest rate, collateral information, and other contractual obligations.

- Disbursement: This section probably handles the disbursement of the loan amount. It might include details about the disbursement date, amount, method, and any related approvals or documentation.

- Collection Schedule: This section outlines the repayment schedule for the loan. It could include installment amounts, due dates, payment methods, and any late payment penalties.

- Case: This section might reference a specific case or file associated with the loan, such as a customer complaint or legal issue.

- Loan: This section likely provides summary information about the loan, including the loan type, purpose, and borrower details.

- Documentation: This section probably stores and manages all relevant documents related to the loan, such as borrower identification, income verification, and property appraisal.

- View CIB: This likely refers to a Credit Information Bureau check, providing a credit history report on the borrower.

- Checklist: This section might contain a checklist of required documents or tasks related to the loan processing.

- View Prospect: This link redirects to the original loan prospect page, allowing for reference or updates.

- History: This section probably maintains a record of all activities and changes related to the loan contract.

- Visit Note: This section might allow for recording notes or observations from site visits or customer interactions.

- Loan Summary: This section provides a concise overview of the loan's key details, potentially acting as a summary page.

- Document List: This section likely displays a list of all uploaded documents related to the loan, serving as a quick reference.

- Close(Ringi & Follow): This section might involve closing the loan or initiating follow-up actions, potentially related to loan recovery or customer relationship management.

Refinancing Process

Refinancing is a process where an existing loan is replaced with a new loan, often to secure better terms such as a lower interest rate, extended repayment period, or to consolidate debt. In the context of your system, this involves closing the current loan contract and creating a new one.

-

Refinance Request:

- The customer initiates a refinance request.

- The customer initiates a refinance request.

-

Contract Evaluation:

- The system calculates the outstanding balance of the current loan.

- A new loan contract is generated with updated terms (interest rate, tenure, etc.) based on the customer eligibility and the system's lending policies.

-

Approval Process:

- The new loan contract goes through the standard approval process, similar to a new loan application. This includes credit checks, document verification, and management approval.

-

Disbursement:

- If approved, the new loan amount is disbursed.

- The disbursed amount is typically used to settle the outstanding balance of the old loan.

-

Closure of Old Contract:

- The system automatically closes the old loan contract upon successful disbursement of the new loan.

- Any remaining balance is adjusted, and the contract status is updated to "closed".

-

Activation of New Contract:

- The newly created loan contract becomes active, initiating the repayment schedule for the new loan terms.

No Comments