Loan Prospect

A loan prospect is essentially a potential borrower who has been identified as a suitable candidate for a loan. The loan prospect process involves identifying, assessing, and nurturing these potential customers to convert them into actual borrowers.

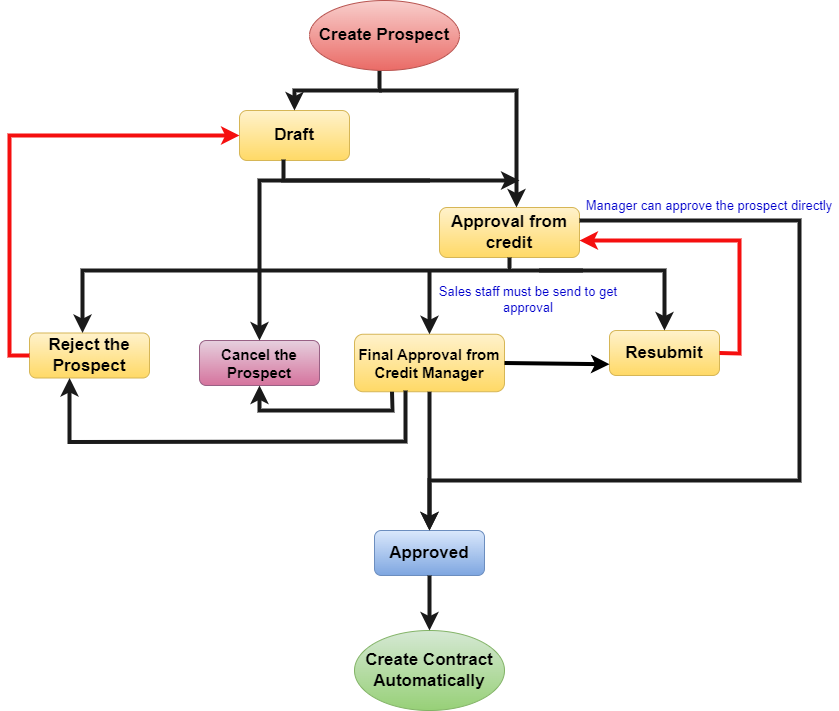

Loan Process

- The "Add New" feature under the "Loan Prospect" module allows users to create a new loan prospect record within the system.

- To facilitate the creation of a loan prospect, the system provides search functionalities based on the following customer identifiers.

-

-

- Customer ID: A unique numerical or alphanumeric code assigned to each customer.

- Family book No: The identification number of an individual or a corporate entity.

- Phone No: The customer's contact phone number.

- Customer Name: The name of the customer.

-

-

- The "Add Prospect Form" functionality appears to be a digital form within your system used to capture information about potential loan customers (prospects). The form is designed to be adaptable based on the type of loan or contract being considered.

- There are Six(6) Contract types.

-

- SME Car - Add Penalty Method field(Old Formula or New Formula)

- SME Bike

- Car Leasing - Add Shop Name field

- Bike Leasing - Add Shop Name field

- Real Estate

- Trade Finance

-

- The fields displayed on the form will change based on the selected contract type. This ensures that only relevant information is collected for each loan type.

- Specific Field Requirements: Certain contract types have additional field requirements:

- SME Car: Includes a "Penalty Method" field with options for "Old Formula" or "New Formula".

- Car Leasing and Bike Leasing: Requires a "Shop Name" field.

- The form is divided into eleven sections, likely covering details such as:

-

- Case

- Loan

- Document

- Collection Schedule

- CIB

- History

- Loan Form

- Location

- Black List

- Relationship History

- Document List

-

- Basic Customer Information - Common fields for all contract types (e.g., name, address, contact details, ID number)

-

Contract Type - Dropdown menu with the six contract types

-

Contract Specific Details - Fields displayed based on the selected contract type (e.g., car model, loan amount, shop name, property details)

1. Case Section

The Case Section appears to be a critical component of the "Add Prospect Form" where detailed information about the potential customer and their financial situation is collected. It also involves capturing information about the sales process and any guarantors involved.

1.1 Sales and Customer Information

- Sales Team: Fields to capture details about the sales personnel involved (Contract Salesperson, Sales Assistant, Call Center Salesperson, Double Count Person, Customer Introduction).

- Call Approach: Depending on whether the customer was approached through a call or a broker, specific fields are displayed.

- Call Approach: If selected, an "Approach List" field is added for detailing the approach method.

- Broker Approach: If selected, "From which Broker" and "Approach List" fields are added.

- Financial Assessment: Fields to capture customer's monthly income, expenditure, and automatically calculate the monthly profit.

1.2 Guarantor Information

- Flexibility: Allows for adding multiple guarantors.

- Two Methods: Offers two ways to add guarantor information:

- Add New Guarantor: Manually input guarantor details, starting with the phone number.

- Add Existing Guarantor: Select a guarantor from an existing list based on their phone number.

1.3 Asset Valuation

- Shows the latest asset valuation record for the current month.

- Allows for selecting one or more valuation records for the prospect process.

2. Loan Details Section

The Loan Details section appears to be a crucial part of the prospect form, providing comprehensive information about the proposed loan. It includes details about the Loan Amount, fees, and other financial terms.

- Payment Schedule Type: Defines the repayment structure (e.g., upfront, installment).

- Initial Date: Automatically set as the prospect creation date.

- Trading Currency: Allows selecting the loan currency (USD, THB, LAK).

- First Payment Date: Typically set for the 5th of the month.

- Number of Payments: Defines the total number of repayments.

- Monthly Interest: Specifies the interest rate.

- Last Payment Date: Calculated based on the First Payment Date and Number of Payments.

Loan Amount and Fees:

- Loan Amount: The total amount to be borrowed.

- Approval Fee Amount: A fixed or percentage-based fee for loan approval.

- Approval Fee: Calculated based on Loan Amount and a predefined percentage.

- Other Cost: Additional charges (e.g., processing fees).

- Advance: Any advance payments made by the customer.

- Net Amount Customer Receives: Calculated as Loan Amount minus Approval Fee Amount.

-

Early Repayment:

- Allows selecting whether early repayment is allowed.

- If selected, a "Min Repayment Period" field is displayed.

-

Broker Information:

- Details about the broker involved in the loan process.

3. Document Section

The Document Section appears to be a critical part of the loan application process, where required documentation is listed and likely tracked for completion.

Mandatory Documents:

- Customer Family Book

- Guarantor Family Book

- Village Head File

- Questionnaire Form

- Real Estate Documents of Customer

Optional Documents:

- Customer ID Card

- Guarantor ID Card

- Accounts Receivable Documents For Customer

- Accounts Receivable Documents For Guarantor

- Real Estate Documents Of Guarantor

- Other (Picture of appearance of home or shop)

- Other (Bank passbook copy etc.)

- CIB Document

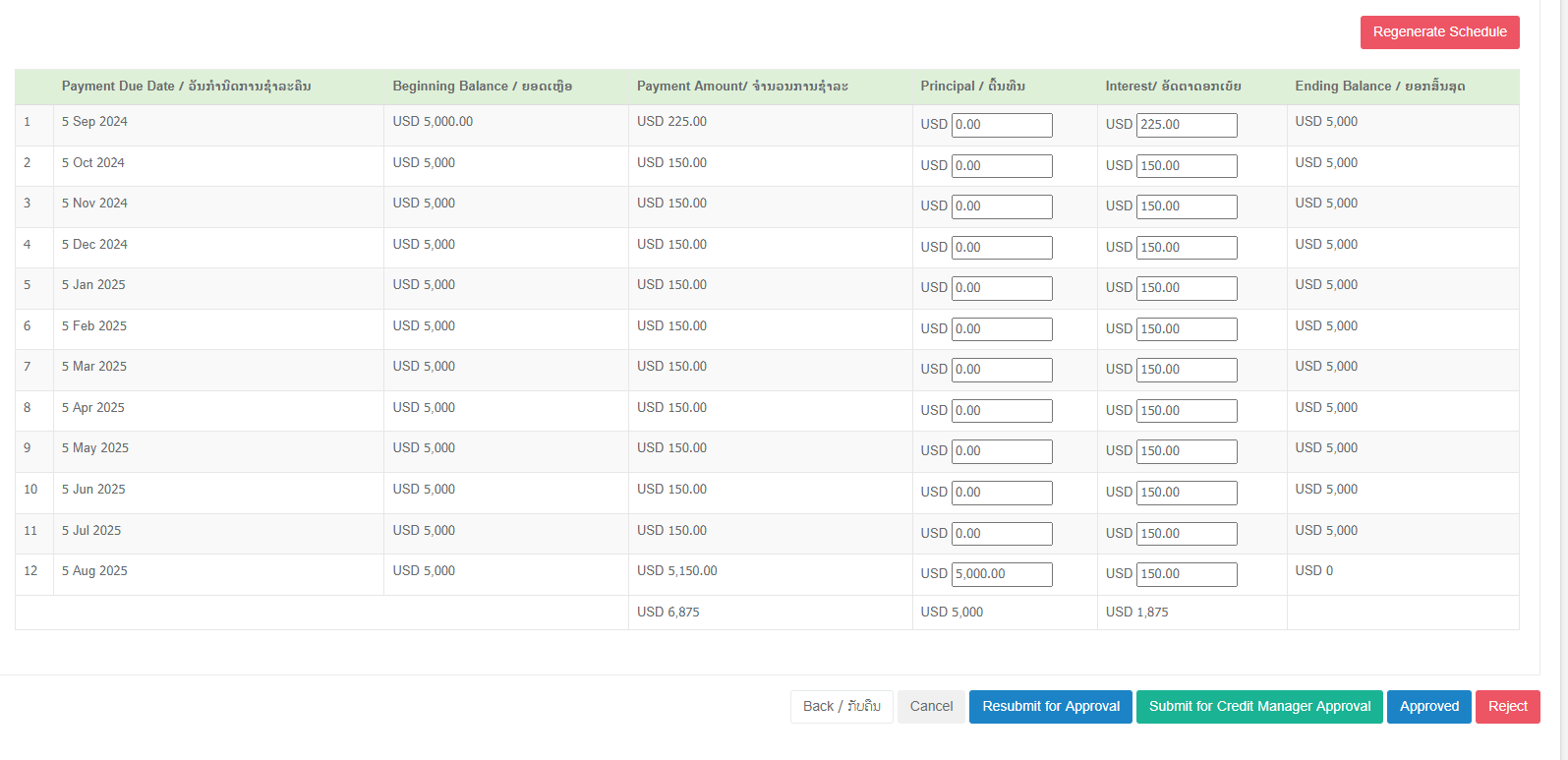

4. Collection Schedule Section

The Collection Schedule section appears to outline the calculation methodology for loan repayments, including principal, interest, and balance updates.

- Payment Amount: The total amount to be paid on each installment, comprising both principal and interest.

- First Interest: Calculates the interest accrued from the Initial Date (loan disbursement date) to the First Payment Date. It's based on a daily interest rate applied to the loan amount.

-

- First Interest - ((Loan Amount * interest)/30) * (First Payment Date - Initial Date)

-

- Other Interest: Calculates the interest for subsequent payments, typically based on the remaining principal balance multiplied by the monthly interest rate.

-

- Other interest - Loan Amount * Interest

-

- Ending Balance: The remaining principal amount after each payment, calculated by subtracting the principal portion of the payment from the beginning balance.

-

- Ending Balance = Beginning Amount - principal Amount

-

- The Collection Schedule provides a basic framework for calculating loan repayments. However, it could be enhanced with more complex interest calculations, detailed amortization schedules, and flexibility to handle various loan scenarios.

5. CIB Section

The CIB (Credit Information Bureau) section is designed to capture and record a customer's credit history information. It appears to be a crucial component in assessing the creditworthiness of a loan applicant.

- Customer CIB Details: This section is dedicated to inputting specific details about the customer's credit history.

- CIB of Customers: A dropdown field likely populated with existing customer CIB records.

- CIB Result: A binary field indicating whether a CIB report exists for the customer.

- Financial Institute: The name of the financial institution that provided the credit information.

- Contract Date: The date of the credit contract.

- Due Date: The original due date for the credit obligation.

- Amount: The original loan amount or credit limit.

- Currency: The currency of the loan or credit.

- Remaining Amount: The outstanding balance on the credit account.

- Delay Days: The number of days the customer is overdue on the payment.

- Rank: A classification of the credit risk, possibly based on the delay days or other factors.

- Collateral Type: The type of collateral associated with the credit, if any.

Note: Corporate & Investment Banking (CIB or BBVA CIB) includes the Group's wholesale businesses, i.e. investment banking, global markets, global loans and transactional services for international corporate customers and institutional investors across its global footprint.

6. History Section

The History section appears to tracking customer interactions, activities, and status changes over time. By capturing detailed information about each interaction, it provides valuable insights for decision-making and analysis.

- History Popup: A modal window that displays a form for recording new history entries and a table for viewing historical records.

-

- Required Fields:

- Person in Charge

- Status

- Rank

- Date

- Amount

- Person Meet

- Dropdown Fields:

- Person in Charge

- Status

- Rank

- History Type

- Date Field: A calendar dropdown for selecting the interaction date.

- Amount Field: A numerical field for recording any associated monetary value.

- Person Meet Field: A text field for recording the name of the person met during the interaction.

- History Type Field: A dropdown to categorize the type of interaction (visit, call, legal, etc.).

- Current Location Field: A field that automatically populates with the customer's location (if available).

- Message Field: A text field for adding additional notes or comments about the interaction.

- History Log Table: Displays a chronological list of previous history entries for the customer.

- Required Fields:

-

7. Loan Form

The loan form is a digital document used within a customer department's customer unit. It appears to be a part of the loan approval process.

Basic Information:

- Department: Customer department

- Unit: Customer unit

Loan Details:

- Bargaining result of department heads: This field likely captures the outcome of negotiations between department heads regarding the loan.

- Things to discuss: A dropdown menu allowing for selection of topics related to the loan.

- First Approval Summary: A dropdown menu to indicate the approval status (Pass, Pass with conditions, or Reject).

- Credit Approval Summary: A dropdown menu to indicate the credit approval status (Pass, Pass with conditions, or Reject).

Form Actions:

- Print: Generates a "Proposal form for credits department report".

- Approval of Leasing Print: Generates "Documents for Approval of Leasing Contract report".

- Approval of Leasing Print view: Displays "Approval Documents".

8. Location Section

Location Section is aim to capture precise geographical information about the customer and guarantor. This section is designed to improve the accuracy of risk assessment, fraud prevention, and overall loan processing efficiency.

Components

- Customer Home Location: This field will capture the geographical coordinates of the customer's primary residence using a map interface. The user can either manually input the address or pinpoint the location directly on the map.

- Customer Work Location: Similar to the home location, this field captures the geographical coordinates of the customer's workplace.

- Guarantor Home Location: This field captures the geographical coordinates of the guarantor's primary residence using a map interface.

- Guarantor Work Location: Similar to the other location fields, this captures the guarantor's workplace location

9. Blacklist Section

The Blacklist Section is a crucial component of the loan form that acts as a real-time check for potential risks. This section is designed to identify if the applicant or guarantor has a history of defaulting on loans or exhibiting other credit-related issues.

10. Relationship History Section

The Relationship History Section provides a comprehensive overview of existing relationships between the loan applicant (customer or guarantor) and the lending institution.

11. Document List Section

The Document List section is a repository for essential documents related to the loan process. It contains a total of 19 different document types, each serving a specific purpose in the loan cycle.

-

Core Loan Documentation

- Loan Contract: The primary agreement between the lender and borrower outlining terms and conditions.

- Table Payment Schedule: Detailed payment plan for the loan.

- MOU of LALCO contract: Memorandum of Understanding related to a LALCO contract (specific details about LALCO contract required for better understanding).

- Payment Guaranty: Guarantee of loan repayment by a third party.

- Advance closure: Document related to early loan repayment (potential fees, terms).

-

Vehicle Related Documents

- Car Re-registration to customer: Documentation for transferring car ownership to the customer.

- Car certificate of customer use: Proof of the customer's right to use the car.

- Save storing Car-Bike Key: Procedure or agreement for storing vehicle keys (likely related to loan security).

- Manual Checklist: Inspection report of the vehicle (condition, mileage, etc.).

- No.1 Auto buy the car: Documentation related to the purchase of the car by a third party (potential intermediary).

- No.1 Auto sell the car: Documentation related to the sale of the car by a third party (potential intermediary).

- GPS Installation: Record of GPS device installation (for tracking purposes).

- Close certificate: Document confirming the end of the loan term and vehicle ownership transfer.

- Sales Certificate: Proof of vehicle ownership.

-

Financial Documentation

- Payment voucher (Loan): Proof of loan payment.

- Payment (Loan): Record of loan payment.

- Receipt (Document fee): Proof of payment for loan-related documentation fees.

- Payment voucher (Broker commission): Proof of payment to a loan broker.

- Payment (Broker commission): Record of payment to a loan broker.

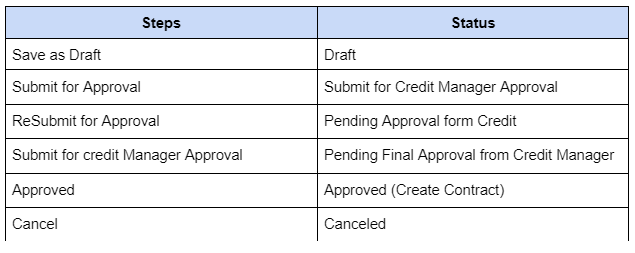

Buttons

Navigation Buttons

- Back: Returns the user to the previous page, specifically the "select customer" page.

- Cancel:

- If no data is entered, returns the user to the "select customer" page.

- If data is entered, changes the loan application status to "canceled".

Approval Process Buttons

- Submit for Approval: Sends the loan application for approval to the Credit Manager.

- Resubmit for Approval: Resubmits a previously submitted loan application for reconsideration by the Credit Manager.

- Submit for Credit Manager Approval: (Seems redundant with "Submit for Approval")

- Approved: Finalizes the loan approval process and generates a contract.

Status Checking Button

- Submit for Credit Manager Approval: (This button appears to have dual functionality)

- Initiates the approval process.

- Opens a "Checklist Result" popup to display the evaluation status of different sections of the loan application.

- Updates the loan application status to "Pending Final Approval from Credit Manager".

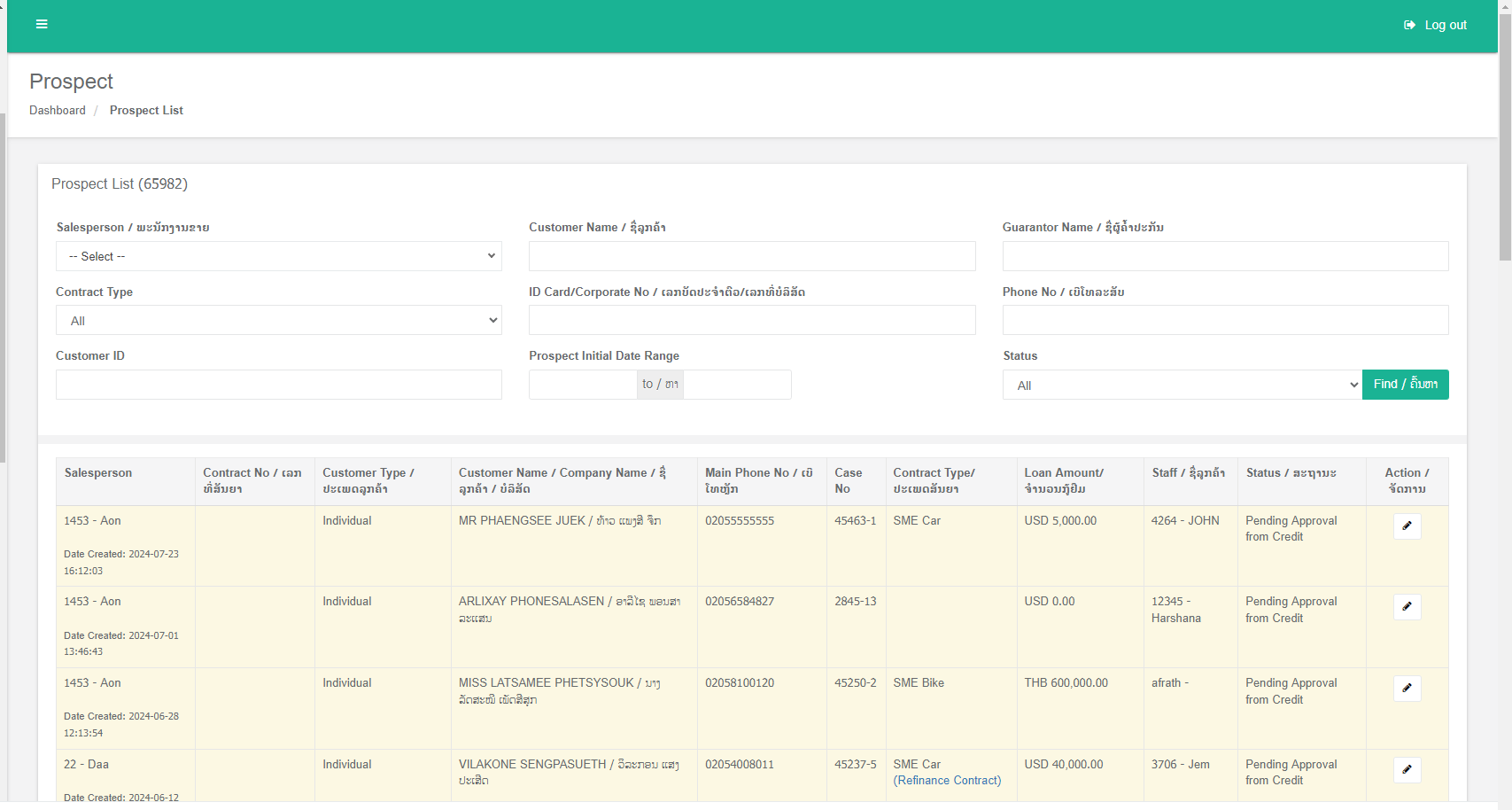

- There are nine(9) search filters.

- Salesperson - This is drop down field

- Customer Name - This is text field

- Guarantor Name - This is text field

- Contract Type - There are five contract types.

-

-

- SME Car

- SME Bike

- Car Leasing

- Bike Leasing

- Real Estate

- Trade Finance

-

- ID Card/Corporate No - This is text field

- Phone No - This is text field

- Customer ID - This is text field

- Prospect Initial Date range - Using this, can search date range

- Status - there are six(6) status

-

-

- All

- Draft

- Pending Approval form Credit

- Pending Final Approval from Credit Manager

- Approved

- Canceled

-

- There are 11 column in the Project List table

-

-

- Salespersons

- Contract No

- Customer Type

- Customer name/ Company Name

- Main Phone No

- Case No

- Contract Type

- Loan Amount

- Staff

- Status

- Action - This options will be change according to the status

-

-

-

-

-

- Draft - edit option

- Pending Approval form Credit - edit option

- Pending Final Approval from Credit Manager - edit option

- Approved - view option

- Canceled - edit option

-

-

-

No Comments